The Embedded Finance Revolution

24th November 2020

“The future is already here. It’s just not evenly distributed yet.” -William Gibson, author of sci-fi classic ‘Neuromancer’

‘Embedded Finance’ is evolving from a slightly mysterious buzzword into the beginnings of a transformation of finance the likes of which we haven’t seen in a long time.

Last year, Matt Harris of Bain Capital Venture predicted that the embedded finance market could grow to $3.6 trillion by 2030 – and that’s just in the United States. In the year since Harris wrote that analysis, activity in the space has speeded up, making that figure look increasingly conservative. The novel coronavirus pandemic has fuelled tech innovation in general (Microsoft CEO Satya Nadella stated just three months ago: “We’ve seen two years’ worth of digital transformation in two months”), including trends in embedded banking and payments.

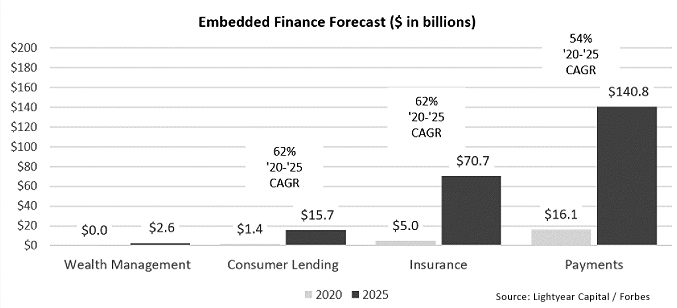

The area of embedded finance activity that stands out for most observers is payments and transactions – traditionally separated, now blended in a growing number of industries, with ride-sharing services (Uber and its competitors) the most conspicuous example. SaaS businesses have massive growth potential, with venture capital giant Andreessen Horowitz estimating that SaaS providers can realistically lift revenue per customer by 2-5 times on the back of embedded financial services like insurance, credit, and payments.

PayPal, Stripe, Square and other payment facilitators have in recent years created an expanding ecosystem of firms that lets anyone, not just fintechs, offer payments. Many of them provide other financial services as well, unlocking even more value. B2B payments, which account for the most significant chunk of the market by volume, are set to be the new growth engine, especially with the adoption of blockchain in payments. Embedded finance has the potential to fix a lingering anachronism: the US National Automated Clearing House Association has found that a whopping 42% of B2B payments in America are still undertaken by cheque!

The embedded finance transformation is, at its most basic, the application of the software-as-a-service model pioneered by the likes of Amazon’s AWS to the world of payments and banking. An army of providers has emerged, letting established firms, as well as entrepreneurs, assemble new offerings using plug-in infrastructure for payments, credit data, insurance data, fraud detection (KYC and AML), and so forth.

Does this transformation mean that traditional banking is in trouble? On the face of it, embedded finance is a democratising force that will allow tech giants such as Facebook, Google, Uber, etc. to offer most of the services that we have so far associated with traditional banks. That said, banks have withstood many tectonic upheavals over the centuries, and they are producing some of the most compelling functional analyses of the opportunities presented by embedded finance. To think they are not ready to meet the latest challenge to their dominance would be a big mistake.

One standout example of the banking industry forging ahead in the embedded payments arena is National Australia Bank’s backing of the Medipass payments system. Embedded in doctors’ practice management software, Medipass is a smartphone payment system. Medipass is seeking to transform the insurance claims and payment process by connecting insurers, providers, and patients. NAB rival Commonwealth Bank has the competing Health Claim service in the works. Further competition may yet emerge from Westpac.

At Finpacific, we keep our eyes trained on the future of finance because our customers need to be future-ready. This razor-sharp focus keeps our cutting-edge treasury management solution, MyTreasur-e, right at the leading edge. We work hard to ensure that MyTreasur-e is one of the best tools for our clients to be prepared to tackle the 21st century.