Will Joe Biden Lead the World to a Cooperative Tax Regime?

04th May 2021

“When the final result is expected to be a compromise, it is often prudent to start from an extreme position.” – John Maynard Keynes

A proposal that would allow leading economies to lift taxes on big American corporations in exchange for a worldwide minimum corporate tax is gaining momentum. Backed by US President Joe Biden, the talks, led by the G20 group and the Organisation for Economic Co-operation and Development (OECD), are likely to have a significant impact on US tech giants such as Google, Amazon, Microsoft, and Facebook.

The 2008 global financial crisis sparked the global tax rethink, but progress has been painfully slow. Competing national and economic bloc interests were further complicated by the inevitable change of leadership in prosperous democracies as the years rolled by.

After a period of uncertainty about the outcome of the talks under former US president Donald Trump, the Biden administration has embraced the two-pronged approach, dubbed benignly by some as the ‘Two Pillars’ strategy. This bland phrase disguises the sharp divisions behind the negotiations, which are being run in the backdrop of some exasperated countries – including Great Britain – having already applied a 2 percent tax (with some caveats) on revenues that tech giants collect from British users.

The Biden administration has agreed, in principle, to something resembling the UK path out of the conundrum that is posed by technology firms’ unprecedented ability to generate revenue and profits from an economy via an entirely virtual presence, without physically operating in that economy.

With some of the biggest and most successful companies often paying astonishingly little tax, the current situation is increasingly creating public resentment – always an impetus for politicians to do something about it.

The US has now also diluted Trump’s strong opposition to a global minimum corporate tax rate – the second of the Two Pillars. This new international minimum tax regime would scuttle big multinational firms’ tendency to move their profits to jurisdictions where they would attract much lower tax. The hope is that, by preventing American corporations from moving elsewhere to save on taxes, the Biden administration could reap more monies to fund its ambitious $2 trillion infrastructure spending program. US Treasury Secretary Janet Yellen wrote in WSJ.com in April that she believes the tax vision of the new administration would help stall the endless competition amongst economies to lower corporate tax rates more than other economies, in a destructive downward spiralling bid to woo multinational corporations.

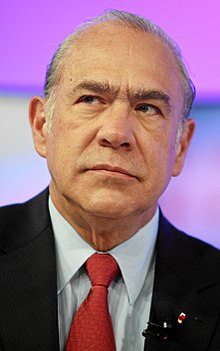

On 29th April, OECD Secretary General José Ángel Gurría expressed the hope that an agreement on the ‘Two Pillars’ approach ‘would rebuild trust in the global tax system.’ The organisation aims to seal a deal in October that includes a rollback of unilateral tech taxes like the UK’s, replacing them with a comprehensive framework that everyone is happy about. More or less.

But, as always with negotiations that demand concessions from other parties, there are no guarantees that the talks will succeed. As John Maynard Keynes warned, the rule in such parleys is this: “When the final result is expected to be a compromise, it is often prudent to start from an extreme position.”

So, let’s not hold our collective breath.

At MyTreasur-e, we keenly track technological, economic, financial, and social trends that can impact our customers. Our passion for anticipating and managing risk in all its forms is what accounts for our customers’ satisfaction with our cutting-edge treasury and risk management solution.