Will the Environment Break Bitcoin?

17th March 2021

Bill Gates has launched a major attack on the size of bitcoin’s carbon footprint. Speaking on the sensational new audio chat social network Clubhouse, the legendary billionaire told journalist Andrew Ross: “Bitcoin uses more electricity per transaction than any other method known to mankind.”

Some estimates in February this year suggest that the electricity consumed by bitcoin could power Argentina, a nation of 45 million people. According to economist Alex de Vries, who has created an index to track bitcoin energy consumption, bitcoin may currently be soaking up as much as 101 terawatt hours (TWh) a year, which equates to about three Irelands.

And bitcoin’s hunger for energy is only increasing. Sometimes with serious consequences, such as when Iran acted against bitcoin miners after suffering power outages that some blamed on crypto farms. And, within only a few months, bitcoin will be hoovering up twice as much power as it did in early 2020.

Gates has lent his powerful voice to a growing number of commentators pointing accusing fingers at the sheer scale of the cryptocurrency’s energy consumption. Other major figures who have cast doubt on bitcoin’s sustainability, in both contemporary senses of the term, include US Treasury Secretary Janet Yellen.

The Microsoft co-founder’s statement stands in stark contrast to fellow top-3 billionaire Elon Musk’s passionate endorsement of bitcoin, which has helped the flagship crypto to break through US$60,000 as we write this piece. (Tangentially: Gates has in the past downplayed Musk’s stature as an entrepreneur, comparing him unfavourably to the late Steve Jobs’ ‘genius.’)

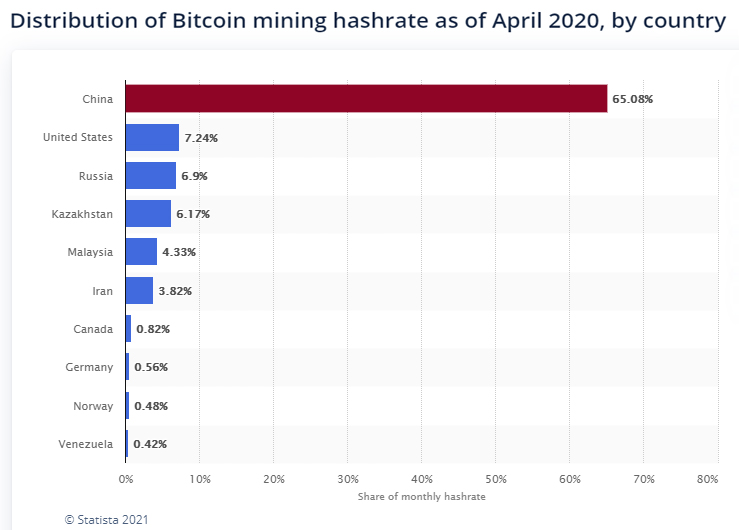

Amid all the hype and scepticism, everyone and their uncle seem to know by now that the leading cryptocurrency is ‘mined’ in sprawling arrays of computers (increasingly, supercomputers) around the world, with China accounting for more than 70 percent of that constantly buzzing infrastructure.

And because China is the world’s biggest producer of coal-fired power, its massive bitcoin infrastructure stamps a correspondingly huge carbon footprint.

So, what accounts for bitcoin’s energy gluttony? According to the International Energy Agency, the energy use of the bitcoin network is driven by factors that include:

- mining hardware specifications, notably power consumption and hashrate;

- network hashrate, the combined rate at which all miners on the network are simultaneously guessing solutions to the puzzle;

- “difficulty” of solving the puzzle, which is adjusted in response to the network hashrate to maintain the target block rate of one block every 10 minutes; and

- energy consumption by non-IT infrastructure, such as cooling and lighting.

For bitcoin, the danger signs include moves by some governments, including New York and Washington State in the US, to curb mining of the cryptocurrency. Some provinces in China have also acted against bitcoin mining, largely because of the carbon footprint issue as the CCP announces its plans for a greener future.

But does this mean that a debilitating crisis for bitcoin could be on the horizon? Despite Bill Gates’ negativity, we wouldn’t bet on the demise of the top cryptocurrency. In fact, these criticisms may drive the use of more sustainable sources of power to make bitcoin more environmentally friendly.

That said, currently we are seeing market distortions caused by bitcoin’s energy use, notably growing interest in gold investment as a hedge against bitcoin’s volatility – which is especially ironic, as one of the drivers of bitcoin originally was its potential as a replacement for the precious yellow metal.

We’ll end with a positive note for bitcoin enthusiasts. Elon Musk, by some measures the world’s richest man and the most popular Western business figure in leading bitcoin miner China, backed the crypto in a major way when Tesla invested US$1.5 billion in bitcoin early this year.

Bitcoin’s price has nearly doubled in this brief time! And that makes Gates’ criticism lose some of its sting.

At MyTreasur-e, we keenly track technological, economic, financial, and social trends that can impact our customers. Our passion for anticipating and managing risk in all its forms is what accounts for our customers’ satisfaction with our cutting-edge treasury and risk management solution.