Navigating Safely Through a High Interest Rate Environment

05th December 2023

“Only when the tide goes out do you learn who has been swimming naked.”

– Warren Buffet

Treasury managers know that the choppy waters of rising rates mean they need to pull themselves up by the proverbial bootstraps. The era of low rates is already a fading, nostalgic mirage.

RBA governor Michele Bullock insists that Australia’s inflation problem is “increasingly homegrown,” but the reasons for rising rates around the world are probably more complex than that. Untangling these reasons is fiendishly complex – it’s far more useful to focus on strategies to navigate through this environment.

Everyone understands the basic challenges: more expensive borrowing, altered returns on investments, and potential impacts on our cash flow. Tackling the pressure is not just about reacting to these changes; it’s about planning ahead, carefully considering both the immediate and the long-term impacts on our organisation’s financial health.

Going back to the basics remains the backbone of any sound strategy.

With the cost of borrowing going up, we need to reevaluate our debt strategies.

- Look Over Existing Debt: We should examine our current debts, especially those with variable rates, and explore options for refinancing or restructuring. According to a recent report in the Financial Times, over the past two decades companies have tended to raise floating-rate debt instead of issuing bonds.

- Thinking Fixed-Rate: It might be a good move to lock in some fixed-rate debts now, to shield ourselves from future rate increases.

- New Borrowing with Caution: Any new borrowing should be essential and make sense in terms of potential returns.

Of course, higher rates mean better returns on certain investments. (Gold – a historically solid, real asset – was the top performer during the Oil Shock period of the 1970s).

But it’s all about balance.

- Liquidity vs. Yield: We need our funds to be accessible but also working for us.

- Diversify to Manage Risk: It’s vital to spread out our investment risks.

- Shorter Durations Can Be Smarter: Shorter-duration investments might help us reduce exposure to rate changes.

As rising rates strain our cash flows, growth stocks, darlings during the period of lower interest rates, tend to give way to value stocks (consumer staples, etc.) Be wary of oversimplifying, but keep time-tested strategies in mind.

- Sharpen Cash Flow Management: Improve our forecasting and tighten up on receivables and payables.

- Update Budgets and Forecasts: We should account for the impact of higher interest rates in our financial planning.

- Build Strong Bank Relationships: Now’s the time to negotiate with our banks and look into new financial solutions.

Interest rate swaps and other derivatives are great for managing rate exposure. But they should be part of a broader risk management strategy, not speculative tools.

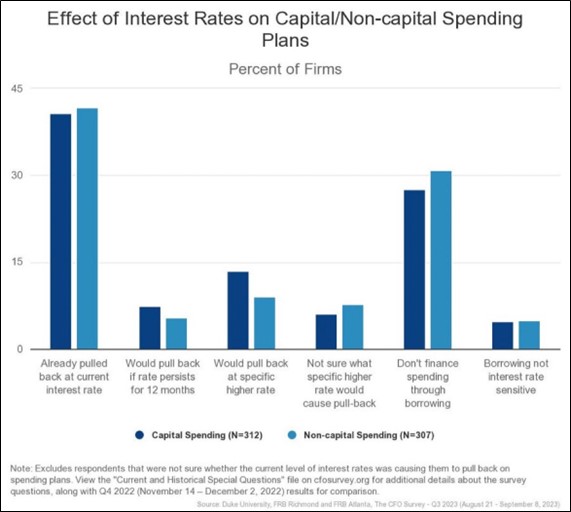

A snapshot view of companies’ responses to the high rate environment in the bellwether US market. (Source: Duke University).

Despite the plethora of analyses and expert commentary, interest rate movements can be hard to predict.

- Stay Updated: We need to keep up with economic trends and central bank policies.

- Flexibility is Key: Be ready to adjust our strategies in response to market changes.

- Communication Matters: It’s important to keep everyone informed about the impact of rate changes and our response strategies.

It’s important to keep in mind that everyone – including some of the biggest companies on the planet – is facing similar challenges in this environment. You’re not alone.

Even Elon Musk stated in October that Tesla’s efforts to cut costs felt like “digging a tunnel with a spoon.”

A no-nonsense approach is the best hope for safe harbour. Navigating through a high interest rate environment requires a proactive, strategic approach. By focusing on intelligent debt management, wise investment strategies, optimising cash flow, risk hedging, and staying flexible, we can not only protect our organisations but also spot opportunities for growth. Being informed, adaptable, and transparent is, as always, the way forward.

At MyTreasur-e, we keenly track technical, social, economic, and financial trends that can impact our customers. Our passion for anticipating and managing risk in all its forms is what accounts for our customers’ satisfaction with our cutting-edge treasury and risk management solution.