BaaS Comes of Age

28th July 2023

“BaaS places a number of requirements on the provider. These services, if you get them right, are not just a technological challenge: They fall right at the junction of technology and banking.”

– Luc Teboul of Goldman Sachs

Banking-as-a-Service (BaaS) has grown out of the broader Software-as-a-Service (SaaS) paradigm. But it is undeniable that the COVID pandemic acted as a propellant, with customers and business clients looking for better accessibility, faster service, and more technology-enhanced reliability of banking products. For example, in the US, bankers partnered with fintechs and tech providers to quickly deploy Paycheck Protection Program (PPP) application modules for their clients at the height of the pandemic.

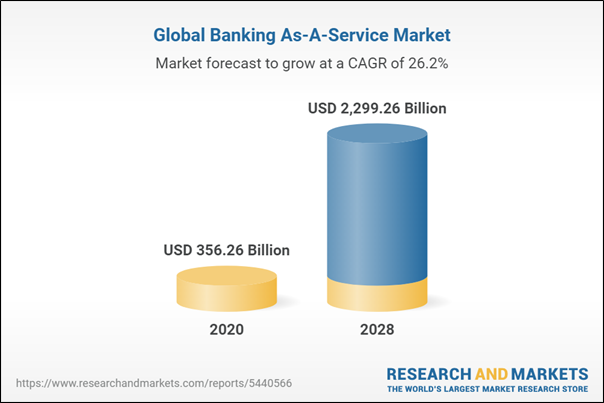

And, despite a few clickbait headlines (like ‘BaaS is Dead’ by Simon Taylor), BaaS is actually growing at a rapid clip this year. According to market research firm FMI, BaaS demand is predicted to grow at a 16.2% CAGR over the next 10 years, up from 14.1% over the past four years. Other forecasters are even more optimistic. (See chart below).

| What is BaaS? A bank-nonbank relationship model may take the form of a front-end relationship model, where the non-bank firm utilises the incumbent’s infrastructure in the delivery of banking products and services, with the non-bank firm interacting directly with the end-user. A special form of the front-end relationship model is often referred to as Banking as a Service (“BaaS”). BaaS can be defined as the provision of banking products (payments, lending, or deposit accounts) as a service through an existing regulated institution’s infrastructure enabled by APIs, thus providing “embedded financial services” to customers on an a la carte basis. Part of the Evolution of SaaS BaaS has emerged from the broader Software as a Service (“SaaS”) trend. The non-bank firms manage the customer experience and user interface often on an already existing product platform and integrate the finance element (merchant financing, payments, etc.) as part of the overall customer experience. Financial services provided through the BaaS relationships tend to be more modular and customised based on customers’ needs and complementary designs required by the non-bank firm. Improved Client Experience For non-bank firms, embedding financial services within their platforms may create additional value for consumers and enhances the customer experience, while regulated insured depository institutions (IDIs) have a chance to grow their deposit base, diversify their loan offerings, and earn additional revenues. Diversity of BaaS Relationships Not all BaaS relationships are one-to-one, where one IDI is the singular banking institution providing services to one non-bank firm. Several smaller IDIs have developed technology that allows them to serve as the IDI infrastructure for many different non-bank firms, which allows the IDIs to offer banking products and services through platforms operated by those non-bank firms. Similarly, many non-bank firms have service contracts with more than one IDI to provide banking products and services through its platform. There are customer-oriented and operational technology relationships within the BaaS ecosystem as well. Fintech Firms Step In Some IDI legacy technology does not allow seamless integration with non-bank firms’ digital platforms. Several fintech firms have emerged that serve as intermediaries between IDIs and their non-bank service providers, thereby providing the non-banks a platform to connect with the IDI. Adapted from U.S. Department of The Treasury |

Research in Britain has found that 64% of respondents want better digital services for account opening, more online banking options, and more user-friendly apps. Firms innovating in the BaaS space are best placed to meet these market expectations.

Several strands of new technology are coming together in BaaS offerings: the stunning development of Artificial Intelligence over the past year, as well as blockchain, the Internet of Things (IoT), Robotic Process Automation, APIs for banking, and more.

Australian banking giants are pushing BaaS like entrepreneurs. (Westpac, for example, describes its BaaS as “a platform engineered like a startup.”) That novelty means that regulatory compliance will, especially, be a key factor in the evolution and growth of BaaS. For customers, BaaS is the front-end for multiple providers in the background, so the trust that compliance promotes is right at the core of BaaS.

For example, the Australian Prudential Regulation Authority (APRA) has flagged its vigilance over strong operational risk management of BaaS. To quote: “An ADI [authorised deposit-taking institution] would need to ensure the BaaS arrangement meets the requirements in draft CPS 230, and that the operational resilience of the ADI would not be compromised, for example through money laundering, cyber-risk vulnerability or breaches of data confidentiality. This includes proposed specific requirements for an APRA-regulated entity to conduct a comprehensive risk assessment before providing a material service to another party, to ensure that it can continue to meet its prudential obligations after entering the arrangement.”

As changing customer preferences, new technology, a new culture of innovation in the banking sector, fintech entrepreneurship, and proactive regulators converge, BaaS looks poised for a great 2023.

At MyTreasur-e, we keenly track technical, social, economic, and financial trends that can impact our customers. Our passion for anticipating and managing risk in all its forms is what accounts for our customers’ satisfaction with our cutting-edge treasury and risk management solution.