Business Risk in Wartime

22nd March 2022

‘Human life has always been lived on the edge of a precipice… If men had postponed the search for knowledge and beauty until they were secure, the search would never have begun.’ – C.S. Lewis, circa 1940

Unreal images from the stunning war in Ukraine are everywhere on broadcast and social media. This war in Eastern Europe is swiftly changing the dynamics of international business in unpredictable ways. For businesses, the war has also brought home the reality of risk from interstate conflict anywhere globally.

Immediate risks to business in any significant way include supply chain disruption, communication disruption, energy shocks, currency exchange rate volatility, and the impact of dispersed workforces and partners around the world. Medium to longer-term effects can touch virtually all areas of business activity. There is a butterfly effect of negative consequences that can cascade out of any conflict of the scale of the Ukraine war, which carries with it the risk of dangerous escalation involving powerful, nuclear-armed superpowers.

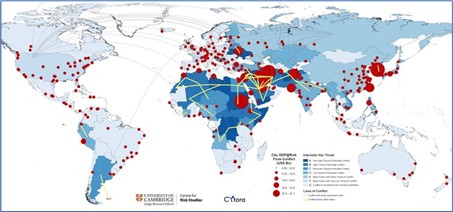

The lesson for businesses is to start looking closely and carefully at their level of exposure to zones of potential conflict and start putting plans in place to shield themselves if growing political rifts spark a new war elsewhere. The Australian Strategic Policy Institute has been focusing on this issue extensively.

[Source: The Conversation]

What can businesses do to mitigate some of these risks? According to author Mark Schwartz, the primary risk (especially in wartime) is lack of agility for businesses. And the key to lack of agility is the cost of the changes the business needs to make to minimise adverse effects from any war, proximate or remote.

The world – especially the prosperous Western world, including Australia – has had a relatively long period of peace, with conflicts in which it has engaged generally located away from these nations. According to historian Niall Ferguson, who has a keen interest in economic history, for many decades, business and financial markets in the West ‘have displayed a remarkable insouciance about political risk,’ which is at the root of all wars.

Highlighting just one stunning piece of adverse data flowing from the combination of the pandemic and the war, Richard Bernstein of investment firm RBA told FT.com this week: “The ongoing supply chain disruptions have now lasted longer than the 1973-4 and 1979 oil embargoes — combined.” The business world is in precarious territory.

Suddenly, major brands worldwide are feeling public pressure to intervene on behalf of one side in the East European war, which is something most have not been prepared for. Consequently, the media is reporting missteps and hesitation by several businesses, causing significant damage to their public cachet and brand image. According to Columbia Business School expert Vanessa Burbano, ‘stakeholders like employees and consumers’ are keeping a close eye on the actions of their companies during this war, and the companies have to respond.

But not all business commentators are busy highlighting the risks from the war. This week, Canadian investment strategist Peter Berezin attracted attention for advising that investors should stay bullish on stocks despite the rising threat of nuclear war. On the other side of the world, investors in China appeared untethered from the travails of the rest of the world, with stocks roaring back after weeks of slides.

The above underscores the vast diversity of opinion in a business world struggling to cope with the intense tremors from a conflict that has burst onto the Western world’s stage after a very long time.

At MyTreasur-e, we keenly track social, economic, and financial trends that can impact our customers. Our passion for anticipating and managing risk in all its forms is what accounts for our customers’ satisfaction with our cutting-edge treasury and risk management solution.