Financial Literacy Is Now Firmly in the ESG Mix

13th August 2022

“Financial Literacy is a Smart Emerging ESG Bet.”

– Global alternative investment management firm Capstone.

As the 2.5-year-old pandemic continues to weigh on the economy at all levels, and geopolitical uncertainties add to the pressures, the need for sound financial literacy is becoming especially important. This has become more relevant as rising interest rates cause stress to individuals and families in Australia, and across much of the rest of the world. And as we are firmly in the middle of the age of Green Investment, economists Anders Anderson and David T. Robinson have presented a strong argument that ‘Green financial engagement is stronger in settings where financial literacy is higher.’

So it makes eminent sense for more Australian companies to be focusing on this critical ESG area of the economy.

Australia’s National Financial Capability Strategy 2022 is the backbone of the effort to raise financial literacy. The strategy states: ‘As Australia recovers from the COVID-19 pandemic, building Australians’ financial capability is a priority for the Australian Government. It will help consumers adapt to an evolving financial and digital landscape and contribute to improved individual prosperity and financial resilience.’ An ambitious goal, but one worth aiming for in these testing times.

Internationally, the Global Financial Literacy Excellence Center (GFLEC) based at George Washington University in the United States is spearheading such efforts. Their website is a must-visit as it brings together lots of information and research initiatives.

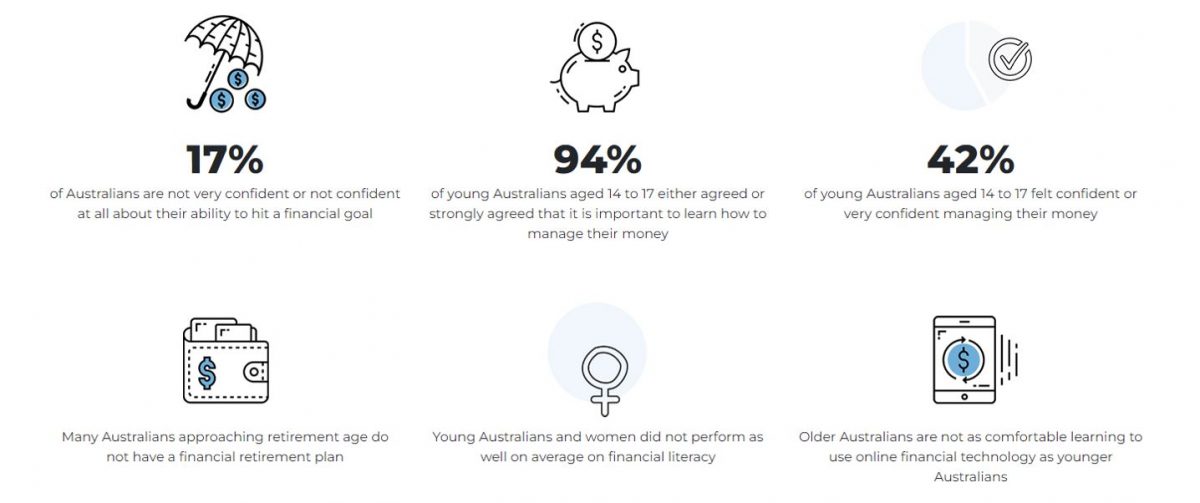

National Survey Snapshot. (Source: Australian Government’s National Financial Capability Strategy.)

Organisations that have partnered with the Australian Government include the non-profit Ecstra, which seeks to ‘ensure that more Australians including children and young people have access to effective financial education, and guidance when they need it.’ Lifting financial literacy in schools is a key priority for governments as well as academics and leaders of the financial world.

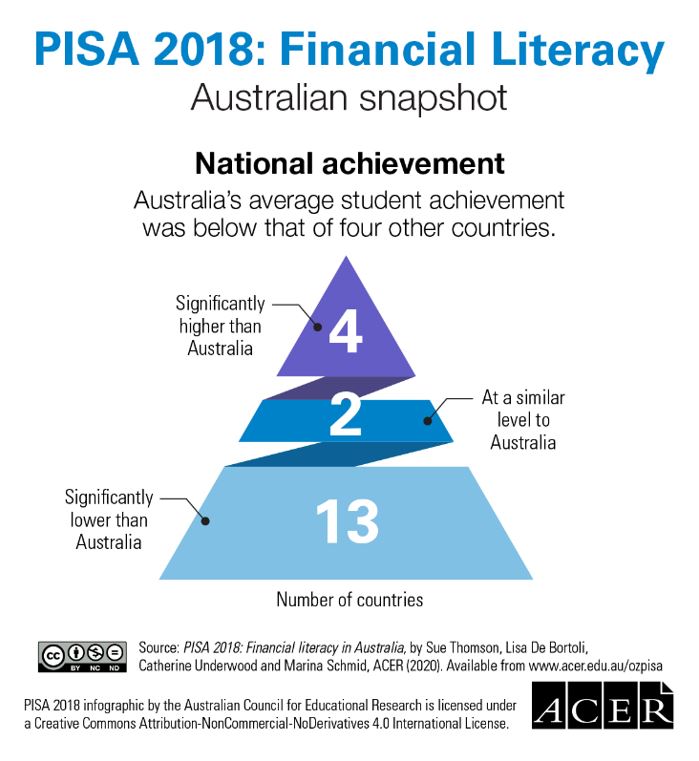

In a recent article in The Conversation, academics Emily Ross and Margaret Marshman have argued for an increased emphasis on financial literacy in the proposed national curriculum. ‘The financial literacy performance of Australian 15-year-olds in the OECD’s 2018 Programme for International Student Assessment (PISA) financial literacy assessment fell by 15 points (or half a year of schooling) since 2012,’ the two authors point out.

Financial experts concur, with leading financial broker Paul Tynan backing compulsory financial literacy in schools, because these ‘basics will go a long way to helping future generations make better and more informed decisions that will ultimately be to their long-term personal and professional betterment.’

According to journalist Noelle Faulkner (writing in Vogue and The Australian), ‘measuring financial literacy is most commonly defined by someone’s ability to understand three concepts: interest rates, inflation and diversification.’ A sound understanding of interest rate movements is always a good idea, but it becomes especially important when inflation begins to hurt – and it is hurting many this year.

Diversification is a time-tested strategy to reduce your risk exposure by spreading out investments over various asset classes. But this needs a good understanding of which assets to pick.

And that need for better understanding again emphasises the need to invest time and effort in your financial literacy.

At MyTreasur-e, we keenly track social, economic, and financial trends that can impact our customers. Our passion for anticipating and managing risk in all its forms is what accounts for our customers’ satisfaction with our cutting-edge treasury and risk management solution.