Open Banking: Rapid Evolution

05th July 2023

“Banks are too big to innovate.”

Max Levchin, co-founder of PayPal

“Governments will always play a huge part in solving big problems.”

Bill Gates

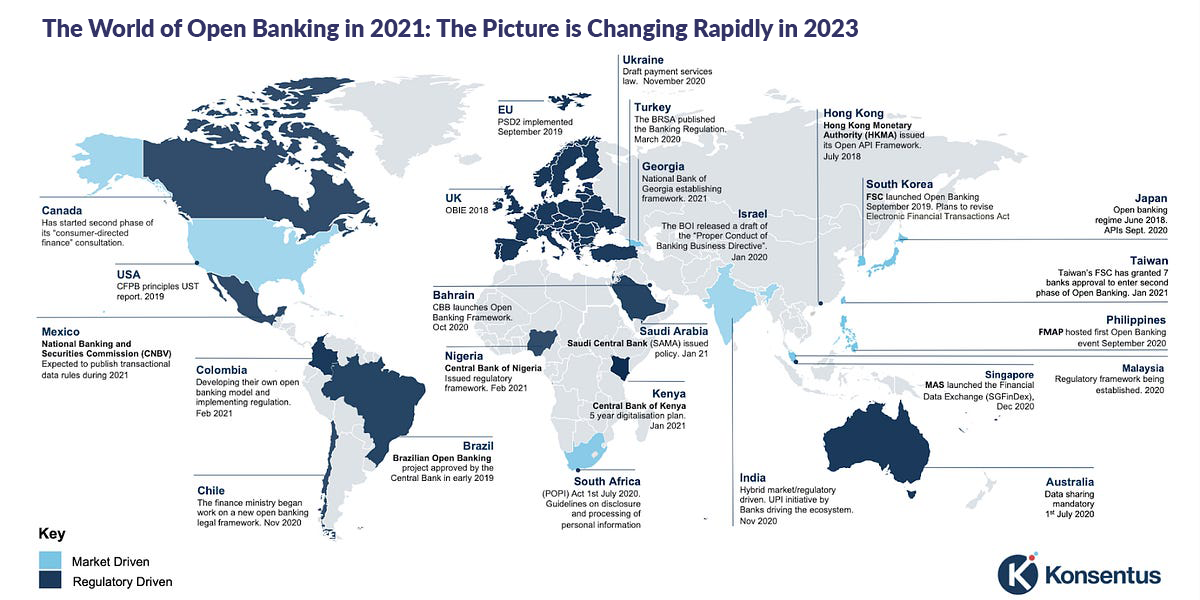

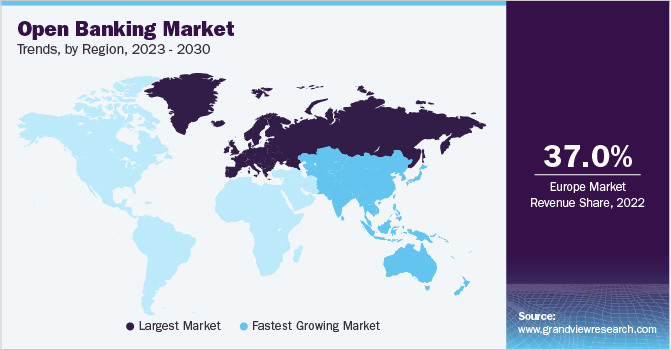

The views expressed above by these two tech innovators are widely held. With Open Banking maturing significantly since its government-backed beginnings in the Europe Union (EU) and the United Kingdom (UK) over the past five years, the role of governments in driving innovation in huge and risk-averse sectors like banking has become undeniable.

According to Deloitte, even the so-called ‘market-driven’ Open Banking initiatives being implemented in economies such as Japan, India, South Korea, and Singapore are driven by government through a range of policy measures. (The US Government, which has adopted the market-driven approach, has struggled with meaningful regulatory initiatives because of the federal structure of decision-making, split across Washington DC and the 50 states).

The regulatory-driven Open Banking pioneers are the EU, with its Payment Services Directive Two (PSD2), and the UK, with its Open Banking Standard.

| What is Open Banking? The essence of open banking regulations is to recognise the banking clients’ right to share their transactional data with authorised third parties and detailed provisions on how to materialise this right. Despite its apparent simplicity, this data-sharing right constitutes the primary vector for fostering the transformation of the retail banking sector from a closed business model to an open platform, similar to what occurred in telecommunications, power, and gas industries. Open banking originated from practitioners and was inspired by the open data, open-APIs (Application Programming Interfaces), and open innovation philosophies applied to the … banking business. The business community is analysing this phenomenon extensively, understanding it as a “collaborative model in which banking data is shared through APIs between two or more unaffiliated parties to deliver enhanced capabilities to the marketplace.” Gorka Koldobika Briones de Araluze and Natalia Cassinello Plaza, Oct 2022 |

The EU has this week forged further ahead with its updated P3D3 proposals. While the 2018 P2D2 unlocked the sharing of third-party data by banks, giving an impetus to embedded finance and other innovations, P3D3 is focused on the following:

- Curtailing the incidence of payment fraud.

- Enhanced consumer rights.

- Equal access to payment systems for banking and non-banking entities.

- Removing obstacles in the path of Open Banking.

- Improved cash availability.

- Better law enforcement.

Despite some scepticism voiced by a few financial industry figures, there is broad enthusiasm for P3D3.

Open Banking marks a major milestone in the role of government in financial innovation. Back in 2009, when then US Federal Reserve chairman Ben Bernanke lauded the government’s track record in encouraging financial innovation, critics like The Economist’s Ryan Avent had pointed out that none of the government-backed innovations cited by Bernanke occurred later than the 1970s.

Australia is in an exciting place when it comes to Open Banking, with many experts (including Deloitte) lauding Australian Open Banking initiatives as both innovative and ambitious in scale.

Following the Commonwealth Government’s 2018 green light for a Consumer Data Right Act (CDR), major banks moved to provide product reference data for products plus account and transaction data in July 2020.

The CDR is unique in that it is a data policy reform and not a solely financial services initiative. Besides banks, CDR will extend to telecommunications and energy as well. The CDR permits consumers to give an accredited business access to their consumer data so that the businesses can offer customised products and services. So, the CDR allows a banking customer to find a provider offering the most suitable product or service for the consumer’s needs.

The Australian Competition and Consumer Commission (ACCC) is the regulatory authority for the CDR.

At MyTreasur-e, we keenly track technical, social, economic, and financial trends that can impact our customers. Our passion for anticipating and managing risk in all its forms is what accounts for our customers’ satisfaction with our cutting-edge treasury and risk management solution.