Why Do Predictions Keep Failing?

29th January 2024

“It is difficult to make predictions, especially about the future.”

– Niels Bohr, Physics Nobel Laureate

As a new year approaches, news sites and various commentators will begin the annual rite of publishing predictions by experts about what to expect in the months ahead.

But these yearly predictions have a dismal history. And there are well-known reasons why these forecasts broadly fall flat on their faces.

Here is the prime cause of the sorry fate of future-gazing: the number of variables used in making predictions has massively increased from the 1970s to the present, across various fields such as economics, geopolitics, environmental science, and technology. The resultant complexity is reminiscent of a combinatorial explosion.

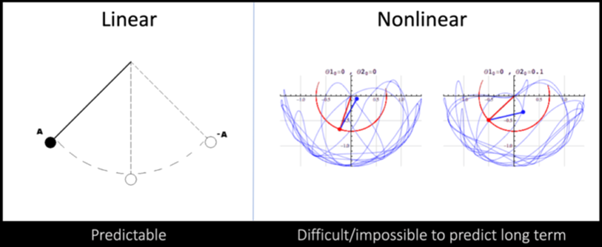

Chaos Theory, often illustrated by the famous metaphor of the Butterfly Effect, gives powerful insight into the complexity of dynamical systems and their resistance to predictions.

In essence, complex systems (geopolitics, economics, climate, global business, etc.) are highly sensitive to initial conditions. Slight variations have disproportionate impact. And these are non-linear systems (see illustration below).

So, it makes sense to focus instead on shorter-term predictions, which tend to be more reliable. And to be agile in the face of increasingly frequent and sudden changes.

(Source: PropertyBuyers.com.au).

To Australians, the unreliability of predictions is the hallmark of the Sydney and Melbourne property markets.

But hundreds of predictions made by famous, highly respected experts over the past couple of decades have gone the wrong way.

The Collapse of the Euro: In the early 2010s, amid the Eurozone crisis, some experts predicted the collapse of the Euro and the exit of Greece and other countries from the Eurozone. However, the Eurozone remains intact, despite encountering some challenges along the way. Interventions by the European Central Bank as well as reforms in key economies helped.

The Arrival of Autonomous Vehicles: Around 2010, there were enthusiastic predictions about the widespread adoption of autonomous vehicles within 5-10 years. However, while significant advancements have been made since then, autonomous vehicles have yet to become mainstream. There remain many technological and regulatory challenges.

The Arab Spring: This supposed unified movement that began in late 2010 led to many predictions about a wave of democratisation across the Arab world. However, these predictions largely did not materialise as expected.

The Fukushima Daiichi Nuclear Disaster: Following the nuclear disaster in Japan in 2011 (in the aftermath of the Tōhoku earthquake and tsunami), there were grave predictions about the long-term environmental and health impacts. But while the disaster did have a significant immediate impact and led to a revival of concerns about nuclear energy, the catastrophic environmental and health consequences that had been predicted did not occur.

Japan’s “Lost Decade” Recovery Predictions: After the “lost decade” of economic stagnation in the 1990s, there were many optimistic predictions in the early 2010s about Japan’s economic recovery. But while there have been periods of growth, Japan still faces several challenges, including an aging population, a high public debt burden, and a broader difficulty in sustaining long-term economic growth to compete with Asian giant China.

So, while annual predictions can provide some valuable insights and help us formulate strategies and policies, they need to be taken as just one of the many available tools for understanding complex global dynamics. It is also prudent to be prepared for the possibility that events may unfold in unexpected ways.

At MyTreasur-e, we keenly track technical, social, economic, and financial trends that can impact our customers. Our passion for anticipating and managing risk in all its forms is what accounts for our customers’ satisfaction with our cutting-edge treasury and risk management solution.