Workflow Automation: How to Make It Fly

01st February 2023

“The first rule of any technology used in a business is that automation applied to an efficient operation will magnify the efficiency. The second is that automation applied to an inefficient operation will magnify the inefficiency.” – Bill Gates

Enterprises in 2023 are aware of the benefits that workflow automation can bring. But it always helps to be reminded of the standout advantages of deploying well-designed workflow automation, as well as the hurdles that successful deployments can face.

Everyone knows the basic textbook stuff: workflow automation can increase efficiency and productivity, improve management and visibility of processes, increase accuracy and reduce the risk of errors, result in better communication and collaboration, and smoothen the way for both internal and external compliance. Overall, the organisation can become much more resilient.

Standardisation of core processes is a necessary prerequisite for successful workflow automation, because you need a clear, consistent, and well-defined set of steps and procedures to follow. Standardisation greatly lifts the chances that the final automation process is reliable, repeatable, and predictable. Standardisation also facilitates easier design and implementation of workflow automation solutions. Monitoring and maintaining workflow automation over time is also smoother with initial standardisation.

Of course, it would be facile to assume that workflow automation results in no subsequent human intervention. Manual interventions will continue to be required at key points in a workflow automation process. An automated workflow cannot make complex decisions on its own, and there will always be decisions that call for intuition, creativity, innovation, empathy, as well as the human ability to tackle uncertainty. Regulations that need to you sign off on compliance also need human intervention. Technology is not omnipotent – there will always be aspects of the process that resist automation.

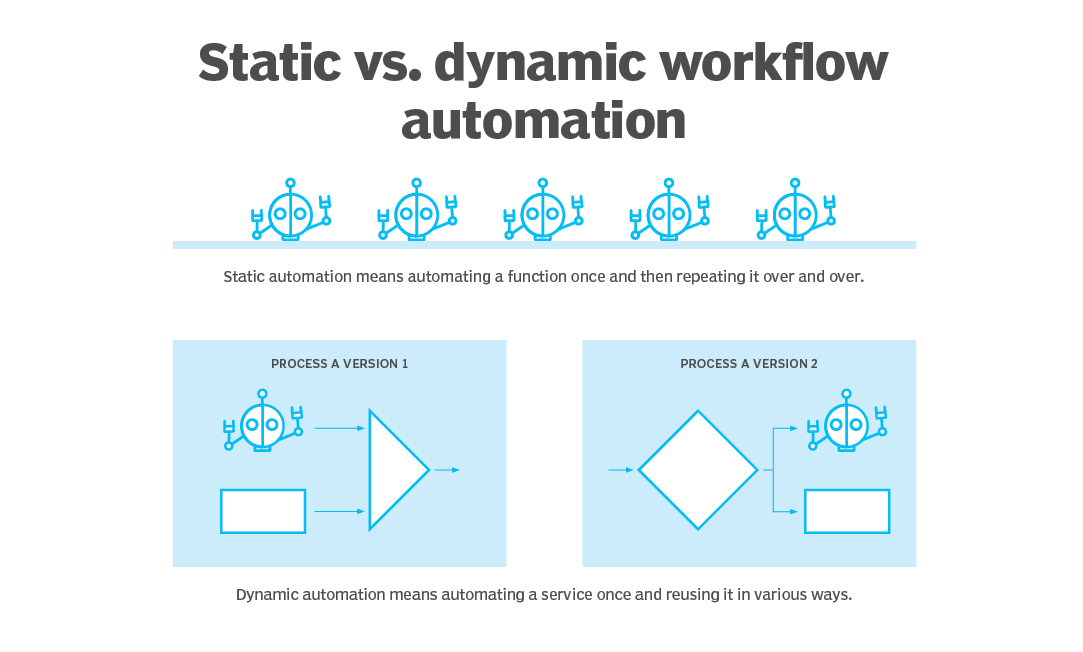

(Image Source: TechTarget)

And remember that data always need to be verified if you want to avoid the risk of ‘dirty data’ clogging up your automated workflows. Poor quality data can result in errors, miscommunication, and inefficiencies in the automated workflow, potentially seriously reducing the benefits of automation.

Broadly, the following steps help ensure data quality:

- Define and document your data requirements. Unambiguously identify what data is required, in what format, and how it should be collected, processed, and stored.

- Implement data validation rules. Checks and validations are needed to ensure that the data fed into the system does not fall short of required data standards.

- Data quality metrics need to be put in place. Regular monitoring of key data quality metrics, including completeness, accuracy, and consistency. This is how you identify and fix emerging issues.

- Data cleansing and enrichment processes. Review and cleanse the data at regular intervals to ensure minimisation of errors, inconsistencies, or duplicates.

- Ensure data security and privacy. This includes measures to ensure the confidentiality, integrity, and availability of the data consumed by the automated processes.

Well-designed and well-maintained workflow automation can be a powerful asset in periods of economic uncertainty, helping ensure that the enterprise runs like clockwork even when employees leave the organisation.

At MyTreasur-e, we keenly track technical, social, economic, and financial trends that can impact our customers. Our passion for anticipating and managing risk in all its forms is what accounts for our customers’ satisfaction with our cutting-edge treasury and risk management solution.